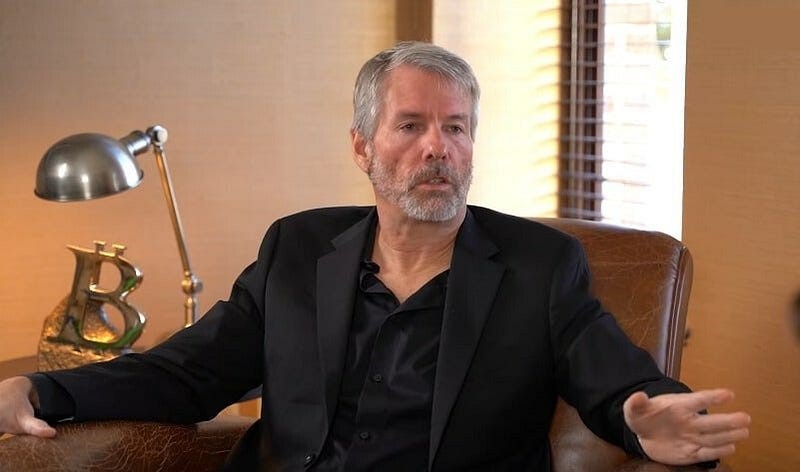

Michael Saylor recently proposed that the US government should buy between 5% and 25% of Bitcoin’s total supply. He shared this idea at the White House Crypto Summit, aiming to make the US a leader in the digital economy.

Saylor’s plan involves the government purchasing Bitcoin daily from 2025 to 2035. By then, most Bitcoins will have been mined. He believes this strategy could create between $16 trillion and $81 trillion in wealth for the US economy by 2045. This potential wealth comes from Bitcoin’s limited supply and its increasing use worldwide.

He suggests that the government should keep the Bitcoin it buys instead of selling it. By 2045, Saylor thinks the Bitcoin reserve could generate at least $10 trillion each year. This income could help reduce the national debt and fund important projects like infrastructure and technology without the need to raise taxes or borrow more money.

Saylor also calls for major changes in crypto regulations. He believes current rules are too strict and hinder the growth of the crypto market in the US. He wants tax policies for crypto miners, investors, and exchanges to be clearer and fairer to encourage innovation and stability in the market.

His regulatory plan divides digital assets into four categories: digital tokens, digital securities, digital currencies, and digital commodities. Each category would have a specific role, providing clarity for future growth in the digital economy.

If the US follows Saylor’s plan and buys the maximum amount, it would own about 5.25 million Bitcoins. This is much more than the 1 million Bitcoins suggested by Senator Cynthia Lummis in her Bitcoin Act. Saylor believes his approach would enhance the US economy, strengthen the dollar, and secure the country’s financial future.