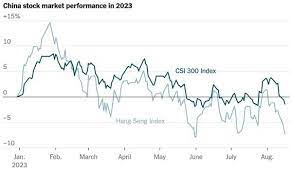

China’s stock market performance has led to a surge in cryptocurrencies, despite the country’s prohibition since 2021.

Finance professional Dylan Run, from Shanghai, reportedly shifted his investments to crypto in early 2023, using bank cards from smaller rural banks to avoid detection.

Dylan Run’s crypto holdings now make up half of his investment portfolio, an over 45% increase in value compared to the stock market’s downturn over the past three years.

This trend is gaining traction among Chinese investors seeking stability away from the faltering stock and real estate markets.

They access digital assets through various channels, including crypto exchanges like OKX and Binance and over-the-counter transactions.

Some investors are also setting up bank accounts abroad to facilitate their purchases. Following Hong Kong’s endorsement of digital assets last year, Chinese citizens are leveraging their $50,000 annual foreign exchange quotas to invest in crypto within the region, diversifying assets offshore amid increased risk and uncertainty in the domestic investment climate.