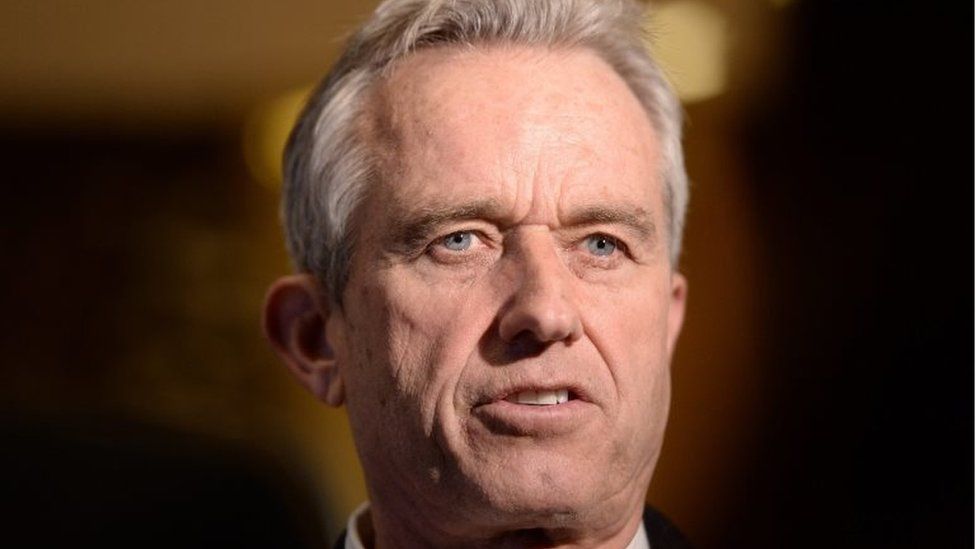

US Presidential Candidate Robert Kennedy has become a proponent of Bitcoin as a safe haven during times of financial instability.

In an era of evolving finance, where cryptocurrencies like Bitcoin are gaining popularity, Kennedy argues that decentralized networks like Bitcoin are less vulnerable to market volatility and government policies, offering an alternative to the traditional financial system.

The US government has been increasingly critical of the crypto industry, with the launch of FedNow, a real-time payment system backed by a version of a central bank digital currency.

Kennedy has voiced concerns about the Federal Reserve’s monetary policies and its relationship with big banks, accusing the Fed of “collusion” with big banks and printing $10 trillion in wealth over the past 15 years, primarily benefiting “Banksters” at the expense of the public.

Kennedy believes that cryptocurrencies like Bitcoin offer an escape route for the public when the current financial bubble bursts, providing an alternative to the centralized control and regulation of the traditional financial system.

Bitcoin operates on a decentralized network, making it less susceptible to risks such as inflation, market volatility, and government policies.

While Kennedy sees Bitcoin as a potential hedge against financial instability, the US government seems intent on cracking down on the nascent industry. However, as cryptocurrencies continue to gain popularity and offer an alternative to the traditional financial system, the debate over their role in the future of finance is likely to continue.