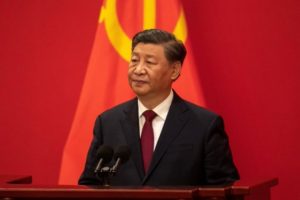

China imposes new tariffs on Canadian goods

China has announced new tariffs on Canadian imports, escalating a trade dispute between the two countries. This decision is a response to earlier tariffs that Canada placed on Chinese goods. The new tariffs will start on March 20, 2025, and will include a 100% tariff on rapeseed oil, oil cakes, and peas, along with a 25% tariff on aquatic products and pork. The trade conflict began when Canada imposed tariffs