The price of Bitcoin has experienced a substantial decrease, declining from $57,000 on September 5 to $55,711.26, resulting in a severe downturn in market mood.

The Crypto Dread & Greed Index has reentered the “extreme fear” zone, registering a score of 22, which is a notable decrease from the score of 29 recorded the previous day.

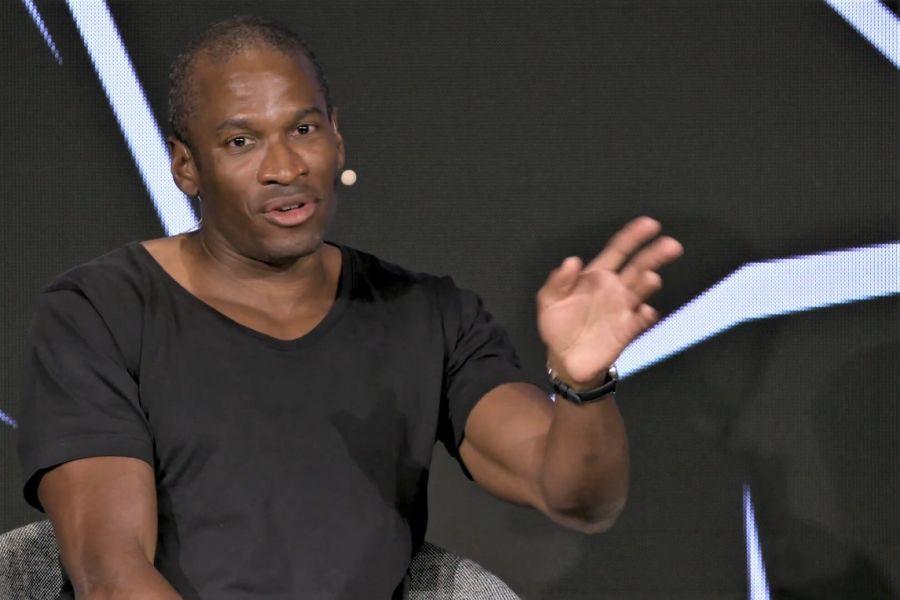

Arthur Hayes, one of the co-founders, forecasts a continued decrease in the price of Bitcoin, indicating that it may drop below $50,000 during the upcoming weekend. This occurs amid a more extensive decline in the market and increasing apprehensions regarding the US economy.

More than 36 million Bitcoin long bets have been liquidated, resulting in a loss of around $29.7 billion from Bitcoin’s market capitalization. Additionally, Ethereum (ETH) has had a decrease of 2.23%, Solana (SOL) has dropped by 2.82%, and Ripple (XRP) has experienced a 2.19% reduction.

As a result, there have been liquidations totaling more than $94.26 million in the last 24 hours, with Bitcoin and Ethereum long bets making up more than 50% of these liquidations.

The current volatility in the crypto market is caused by broader macroeconomic issues, specifically the recent underperformance of the US jobs data.