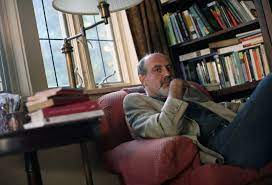

On Twitter, renowned author Nassim Nicholas Taleb, known for his influential book “Black Swan,” took a critical stance against the rapidly growing non-fungible token (NFT) industry.

He highlighted the significant drop in value that some tokens have experienced since their peak, questioning their suitability as an investment choice.

Taleb’s criticism resonated as he pointed out the lack of intrinsic value in NFTs, emphasizing the speculative nature that surrounds them.

Nassim Taleb’s tweet served as a potent critique of the NFT market, raising concerns about their viability as investments.

He attributed their decline in value to the absence of any inherent value, highlighting that the speculative behavior surrounding NFTs can lead to inflated prices that are unsustainable in the long run.

The catalyst for Taleb’s tweet was a response to another user’s post, which highlighted Jack Dorsey’s first tweet being sold as an NFT for a staggering $2.9 million in March 2021.

However, the recent bid for the same tweet was a mere $1.14, showcasing a significant drop in value since its initial sale.

The NFT market has been experiencing a substantial downturn, with average sale prices of these tokens plummeting by over 90% from their peak in various cases.

Taleb had previously expressed skepticism about the NFT industry, stating that the “NFT thingy” was beginning to burst back in April.

In contrast to the NFT market, the cryptocurrency market has been showing signs of recovery. Ethereum, a prominent network for issuing NFTs, has recently risen to test the $2,000 mark, and analysts predict a potential upside potential of nearly 60%.

Institutional investors are increasingly turning to cryptocurrencies, with investment products focusing on Bitcoin, Ethereum, and XRP seeing significant inflows of funds. Despite the downturn in NFTs, cryptocurrencies, particularly Ethereum, continue to attract investor interest.