Dubai, UAE, May 15th, 2024

Largest crypto exchange now offers more than 120,000 active trading strategies, and over 70% of active Spot Copy Trading Lead Traders have recorded positive P&L.

Binance, the leading blockchain ecosystem behind the world’s largest crypto exchange by trading volume, today announced the launch of Funding Rate Arbitrage Bot and the full roll out of Spot Copy Trading to all eligible users.

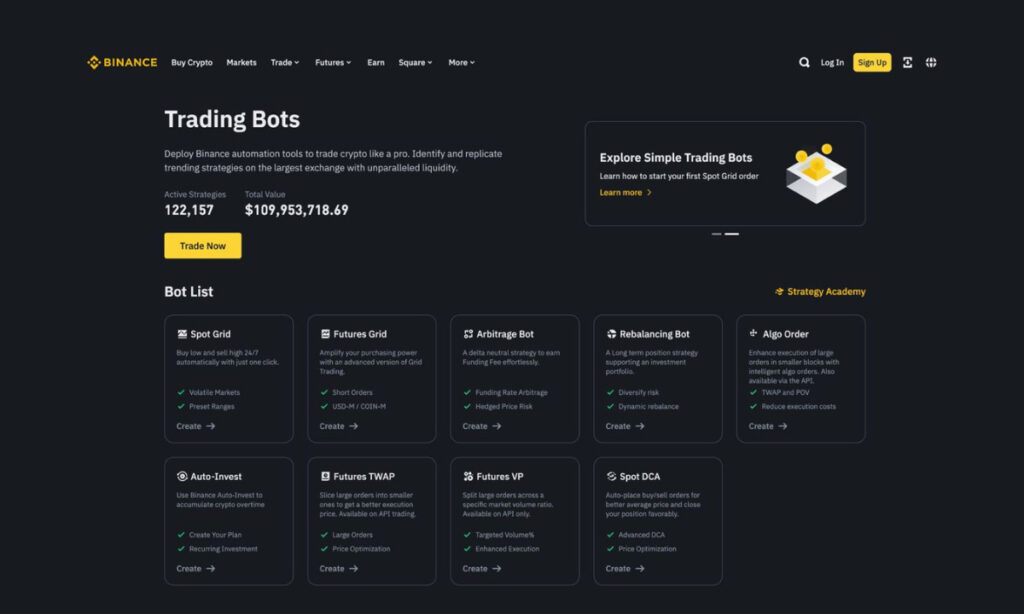

Binance currently offers on its Trading Bots Marketplace over 120,000 active trading strategies and continues to enhance its diverse offering of automated trading strategy tools for users. Automated trading bots that are highly popular with users include Grid Trading for Spot and Futures, Rebalancing Bot, Auto-Invest, and Dollar-Cost Averaging (DCA).

Funding Rate Arbitrage Bot is Binance’s first trading bot that automates a delta-neutral spot and futures arbitrage strategy, removing the need for users to manually execute two separate spot and perpetual futures trades. The Arbitrage Bot aims to allow traders to earn funding fees by opening a perpetual futures position and hedging it by taking an opposite position of the same size on the same symbol in the spot market.

The benefit of the Arbitrage Bot over manually implementing an arbitrage strategy lies in its automated execution of both the spot and futures trades simultaneously once the user has entered their strategy parameters, so users no longer have to separately manage two trade orders on different trading interfaces. The Arbitrage Bot strategies are independently managed in users’ trading bots wallet, also making it easy for users to monitor their performance.

Funding fees are unique in crypto markets and are designed to help keep spot and perpetual futures prices aligned. Long traders pay short traders the funding fee when the funding rate is positive as a result of a bullish trend, and short traders pay long traders the funding fee when the funding rate is negative as a result of a bearish trend.

The Arbitrage Bot allows users to deploy two types of strategies:

- Positive Carry: The bot buys assets on the spot market and shorts the corresponding perpetual futures contract, aiming for the user to collect funding fees from a positive funding rate.

- Reverse Carry: The bot sells assets on the spot market and goes long on perpetual contracts, aiming for the user to collect funding fees from a negative funding rate.

The Arbitrage Bot is available on the Binance website and will be released on the Binance App on May 30.

Rohit Wad, Chief Technology Officer of Binance, shared, “We believe in giving users more choices and we constantly review community feedback to understand what users want. Our Funding Rate Arbitrage Bot is a simple and effective tool to automate for users who already manually deploy arbitrage strategies. Its user-friendly interface means more users can try new strategies. We continue to build trading tools for our users and we are pleased that the community’s reception to our Spot Copy Trading launch has been very positive with over 700 Lead Traders registrations so far.”

Copy Trading Fully Available to All Eligible Users

Binance introduced Spot Copy Trading in response to user demand and first released the feature to Lead Traders in late April.

More than 70% of active Lead Traders have recorded positive P&L since registering for Spot Copy Trading, against a market that was particularly volatile and which had seen overall crypto market capitalization drop by 11% in April.

Following the successful introduction of Spot Copy Trading to Lead Traders in April, the feature will be fully available to all eligible users from May 15 onwards to follow Lead Traders and replicate their portfolios.

Disclaimer: Digital asset prices can be volatile. The risk of utilizing an Arbitrage Bot includes, and is not limited to, that if the direction of the funding rate reverses while employing a futures arbitrage strategy, you may end up paying instead of earning a funding fee. If the price discrepancies between the Spot and Futures markets in respect of the relevant underlying Asset(s) becomes larger, and/or in scenarios where liquidity is insufficient on either side, there may be delays or difficulties in either opening or closing positions reflected in Arbitrage Transactions. Both may undermine the effectiveness of the intended Arbitrage Bot Strategy. You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur. Use of Arbitrage Bots involves futures trading, which is subject to high market risk and all of your margin balance may be liquidated in the event of adverse price movement. The value of your investment may go down or up and you may not get back the amount invested. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment. Content on our platform does not contain advice or recommendations. This material should not be construed as financial advice. Unless the context otherwise requires, capitalized terms used in this disclaimer shall have the meanings given to them in the Binance Trading Bots Terms. Arbitrage Bot is restricted in certain countries and to certain users. This content is not intended for users/countries to which restrictions