Not every coin that’s moving is worth your attention, but some are showing real momentum tied to tech, user growth, or clear economic value. These are the tokens that are getting real traction, and not just price pumps. If you’re trying to filter through the noise, this breakdown of the top trending crypto right now gives you a tight, focused list with strong fundamentals and utility backing each pick.

From AI-driven agent economies to scalable Layer-2 gaming chains and cross-platform interoperability, these aren’t passive tokens, they’re connected to active ecosystems. Unstaked is breaking ground with autonomous AI agents, Sonicis transforming Solana-based gaming, Cronos is building institutional traction, and Stellar is expanding its transaction and address base rapidly. If you’re looking to spot the top trending crypto plays early, these four give you a solid foundation to watch or act on immediately.

1. Unstaked – AI Agents That Actually Work

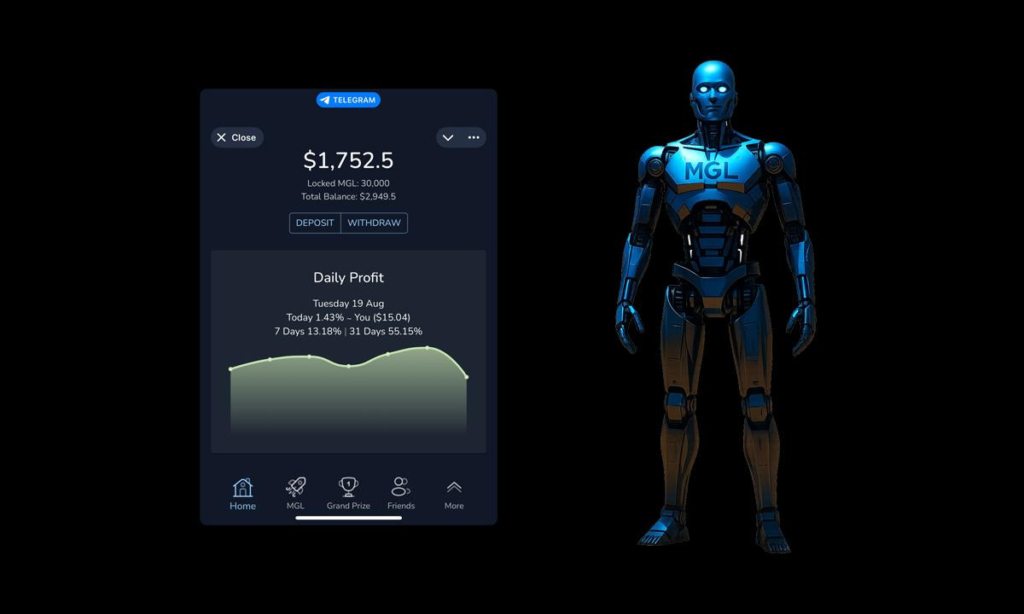

Unstaked is giving users the tools to launch real, working AI agents that operate autonomously across X (formerly Twitter) and Telegram. These agents manage community growth, automate support, distribute content, and engage 24/7, all on-chain. At just $10–$25/month, they’re dramatically cheaper than hiring humans, while offering full transparency through an immutable “Proof of Intelligence” framework. That performance gets logged on-chain, which also decides how $UNSD rewards are distributed. This isn’t automation for hype, it’s utility linked to real output, which makes Unstaked a serious top trending crypto project for 2025.

The $UNSD token is used for everything, agent deployment, marketplace access, and governance voting. With a presale price of $0.0065 and a projected launch near $0.1819, early investors are looking at up to 2700% ROI potential. There’s no private sale, no early VC discount, and everything launches with $20 million in liquidity. The roadmap includes platform expansion to Discord and Instagram, agent NFTs, and full user-owned governance. In terms of top trending crypto, Unstaked offers a mix of tech, transparency, and active ROI that few other tokens can match right now.

2. Sonic – Solana’s New Gaming Layer

Sonic is a Layer-2 solution built on Solana, optimized specifically for gaming. It just launched its Mobius mainnet using HyperGrid infrastructure, allowing it to process millions of in-game transactions while settling back to Solana L1. What sets Sonic apart, and puts it on the list of top trending crypto right now, is the speed and scale it offers developers. It’s not just claiming high throughput; it’s already seen over 8 million testnet users and has raised $12 million in Series A funding to grow the Solana gaming ecosystem.

Sonic is also running a targeted airdrop campaign, distributing 7% of the total token supply to users who played the SonicX tap-to-earn TikTok game and other community contributors. That’s building active demand ahead of a broader token rollout. For developers, this is one of the few platforms that bridges mobile gaming to blockchain performance at scale. For users, it’s a low-cost entry into a high-growth corner of crypto. If you’re tracking the top trending crypto in gaming, Sonic’s timing, tech, and testnet traction make it one to keep firmly on the radar.

3. Cronos – Exchange Layer Meets Institutional Push

Cronos (CRO) is currently priced at around $0.0825, with recent highs touching $0.113. It’s up over 33% in a week and drawing attention after Crypto.com’s recent partnership with Trump Media to launch ETFs tied to cryptocurrency baskets that include CRO. That combination of political visibility and institutional integration is giving Cronos a new edge. With the Cronos zkEVM mainnet upgrade scheduled, smart account functionality and zero-knowledge gateway interoperability are also in view. These developments push Cronos squarely into the top trending crypto conversation.

What separates CRO is that it’s tied to one of the largest centralized exchanges in the world, but it’s building a multi-chain, decentralized layer that connects natively to DeFi protocols. As user activity and token interest rise, analysts have flagged a bullish engulfing pattern on the charts, showing clear short-term buy pressure. With new staking mechanics and a fresh ETF narrative, Cronos isn’t just holding ground, it’s making a credible jump into mainstream finance integration. Among the top trending crypto picks, CRO brings institutional mechanics, technical upgrades, and price movement that investors are watching closely.

4. Stellar – Growing Use, Real Transaction Flow

Stellar (XLM) is currently trading at $0.2430, with a growing number of active addresses, over 1.4 million in the past 30 days. During that same period, the network processed more than 74 million transactions. That’s not speculative volume, it’s real economic activity. With open interest climbing 2.96% over the last 24 hours and a technical RSI holding steady at 63.42, Stellar is showing controlled, bullish movement. These signs put it high on the list of top trending crypto for April 2025.

The fundamentals are matching the momentum. Stellar recently announced an upcoming meetup in New York in collaboration with BABs, SDF, and Sparx. On-chain metrics are pointing toward a network that’s gaining daily users and usage without artificial boosts. Its DMI also shows bulls in control, with the ADX pushing past 30, a sign of trend strength. At its price point, Stellar gives investors exposure to an established blockchain with consistent utility, low fees, and growing developer adoption. If you’re looking at the top trending crypto with real use case traction and steady technicals, XLM is one of the most stable options in play.

Look Beyond Price and Into Participation

The top trending crypto picks right now are connected to ecosystems that are growing, not just pumping. Unstaked is creating a new labor class through AI agents with built-in proof of ROI and token utility. Sonic is handling transaction volume at gaming scale while building its L2 on Solana. Cronos is making the leap from exchange token to institutional product. Stellar continues to show that daily usage and consistent address activity matter when the hype clears out.

All four projects have strong reasons to be on this list, whether it’s tech, market timing, or how they connect to users and devs. If you’re building a watchlist or looking to enter with purpose, these are more than just price charts. They’re signals of movement, value, and real participation. When it comes to picking the top trending crypto, these aren’t just names, they’re active systems with things actually happening.

Disclaimer: Any information written in this press release does not constitute investment advice. Optimisus does not, and will not endorse any information about any company or individual on this page. Readers are encouraged to do their own research and base any actions on their own findings, not on any content written in this press release. Optimisus is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release.