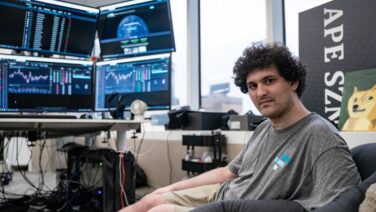

DOJ Seeks to Restrict Sam Bankman-Fried’s Bail to Flip Phones Only

The United States Department of Justice has proposed new bail conditions for former FTX CEO Sam Bankman-Fried (SBF), requesting he is restricted from using smartphones, tablets, computers, and other devices that allow chat and voice communication. The proposal restricts his communication to a flip phone or other non-smartphone with either no internet capabilities or internet capabilities disabled. The proposal was submitted to District Judge Lewis Kaplan of the Southern District of New York, requesting to make the temporary bail conditions recently imposed permanent. The temporary terms include no contact or communication with current or former employees of FTX or Alameda