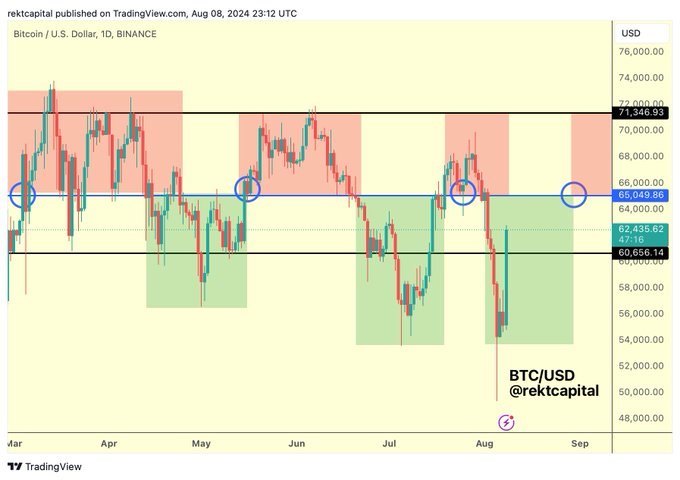

Bitcoin (BTC) surpassed the $60,000 mark on August 8th and must now maintain the $60,600 level as support on the daily chart to potentially reach $65,000 again. This analysis comes from a trader named Rekt Capital on X.

The upward surge was likely initiated by BTC’s pursuit of a CME gap ranging from $59,400 to $62,550. Bitcoin has returned to its weekly trading range of $57,000 to $67,000 and is currently testing the highest price on the monthly chart.

The “post-halving re-accumulation phase” may be nearing its end, and the immediate future still poses a substantial obstacle for Bitcoin.

On August 8, Bitcoin exchange-traded funds (ETFs) experienced two consecutive days of increased investments, with BlackRock’s IBIT leading the way by gaining $157.6 million in assets under management.

Additional exchange-traded funds (ETFs) that contributed to the increase in assets under management were Fidelity’s FBTC, ARK 21Shares’ ARKB, and VanEck’s HODL.

These ETFs experienced inflows of $65.2 million, $32.8 million, and $3.4 million, respectively. Grayscale’s GBTC had further outflows, with a total of $182.9 million withdrawn from the fund yesterday.