Stabull Finance, a decentralized platform providing an alternative to SWIFT and CME for on-chain FX and tokenized commodity swaps, has officially launched on Ethereum and Polygon. The platform’s launch follows six months of beta testing, processing over $2 million in stablecoin swaps since October. Now open to the public, Stabull Finance invites stablecoin issuers and liquidity providers to participate in its liquidity pools and join us in bringing the multi-trillion-dollar FX and commodity markets on the chain.

Stabull Finance offers a 24/7 decentralized exchange (DEX) providing fast, low-slippage, and low-cost swapping between supported stablecoins and tokenized real-world assets (RWAs). The initial launch features tokenized gold (PAXG) on Polygon, along with eleven fiat-backed stablecoins across Ethereum and Polygon. Supported stablecoins include BRZ (Brazilian Real), COPM (Colombian Peso), EURS (Euro), GYEN (Japanese Yen), NZDS (New Zealand Dollar), PHPC (Philippine Peso), TRYB (Turkish Lira), XSGD (Singapore Dollar), with three USD-backed stablecoins; USDC, USDT, and DAI. Additional stablecoins and tokenized RWAs will be regularly added to the platform on an ongoing basis.

While non-USD currencies account for over 40% of global Forex trading, less than 1% of on-chain volume involves non-USD stablecoins. With more than 25 million crypto wallets holding stablecoins and major players like Visa, Stripe, BlackRock, and Goldman Sachs entering the space, demand for on-chain FX solutions is set to surge. Stabull is poised to meet this growing demand, enabling instant and transparent swaps for web3 and institutional use cases such as e-commerce, cross-border payments, merchant settlement, point-of-sale, payroll, and B2B invoicing.

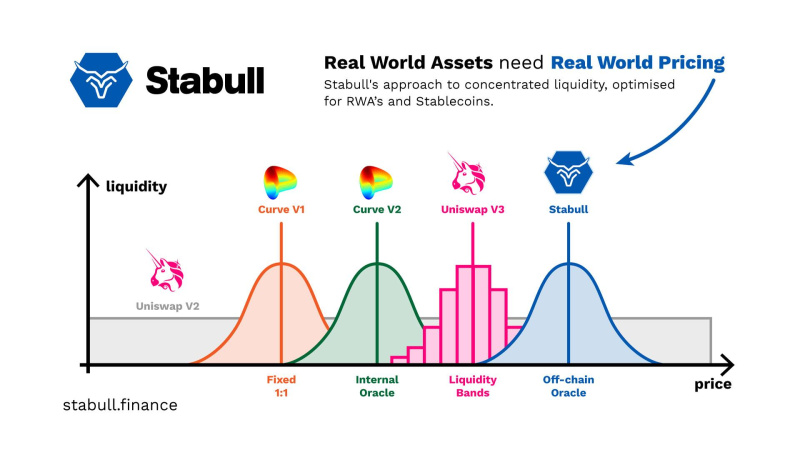

Generalized automated market makers (AMM’s) such as Uniswap and Curve are not optimized for RWA’s where price discovery largely occurs off-chain. This results in stale pricing, impermanent loss, and poor yields for liquidity providers (LP’s), and has contributed to the slow adoption of FX stablecoins. To solve this problem, Stabull’s AMM dynamically concentrates liquidity around an off-chain, Chainlink oracle (e.g. EUR/USD price), resulting in higher capital efficiency for LP’s, price improvement for traders, and relieved peg pressure for issuers.

Fran Stajnar, Core Contributor at Stabull Labs, described the platform’s potential: “Stabull Finance introduces a fourth-generation AMM powered by off-chain price oracles. This 24/7 decentralized venue for stablecoins and tokenized RWAs meets a critical need in the multi-trillion-dollar market for crypto, commodity, and forex traders.”

As well as facilitating swaps, Stabull provides a sustainable APR for holders of non-USD stablecoins and RWA’s, which have traditionally struggled to find yield opportunities on-chain. LP’s on Stabull are rewarded with $STABUL tokens for providing liquidity to the platform as part of the Liquidity Mining Program. Holders of the governance token can then participate in governance proposals and gauge voting to determine future pool yield.

In preparation for its token generation event (TGE) planned for Q1 2025, Stabull Finance is running a monthly 10,000 $STABUL airdrop campaign. This initiative rewards users who provide initial liquidity to the platform’s pools or execute swaps between supported stablecoin and tokenized RWA pairs. Additionally, existing holders of at least $1 worth of BRZ, COPM, EURS, NZDS, PAXG, PHPC, TRYB, or XSGD can qualify for the airdrop by completing a simple wallet balance verification task.

More information about Stabull Finance is available on the website, the app, and supported pools across Ethereum and Polygon. Traders can also connect with the team and community on Discord or follow Stabull Finance on X, LinkedIn, Telegram, and YouTube.

About Stabull Finance

Stabull Finance offers a proactive Automated Market Maker (AMM) on the Ethereum and Polygon blockchains, supporting a growing portfolio of real-world assets (RWAs) and fiat-backed stablecoins. It aims to provide essential infrastructure for the FX and Web3 ecosystem, facilitating the trading of non-USD stablecoins and other RWAs with low execution costs, instant settlement, and capital-efficient liquidity provision.

Media Information

Users can contact the team by email via outreach@stabull.finance and a media kit is available to download here.

Disclaimer: Any information written in this press release does not constitute investment advice. Optimisus does not, and will not endorse any information about any company or individual on this page. Readers are encouraged to do their own research and base any actions on their own findings, not on any content written in this press release. Optimisus is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release.