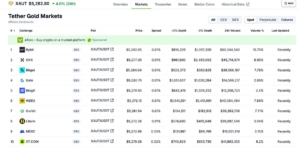

MEXC ICP Zero-Fee Gala Draws Over 80,000 Registrants and $1.5B in New User Trading Volume

MEXC, the world’s fastest-growing digital asset exchange and a pioneer of true zero-fee trading, has concluded the ICP Zero-Fee Gala, a 32-day campaign held from January 15 to February 15, 2026 (UTC), featuring a $2 million reward pool. It generated $1.5 billion in trading volume from new users alone, reflecting strong market interest in the ICP ecosystem and user trust in MEXC. The ICP Zero-Fee Gala attracted 350,000 unique visitors and