Coinbase stated on October 24 that the MakerDAO board had voted in favor of the proposal to take custody of $1.6 billion USDC with Coinbase Prime.

This means that Coinbase has for the first time extended its USDC rewards program to an institutional client. MakerDAO will keep the money with Coinbase Prime, the company’s institutional broker, and earn 1.5% on it.

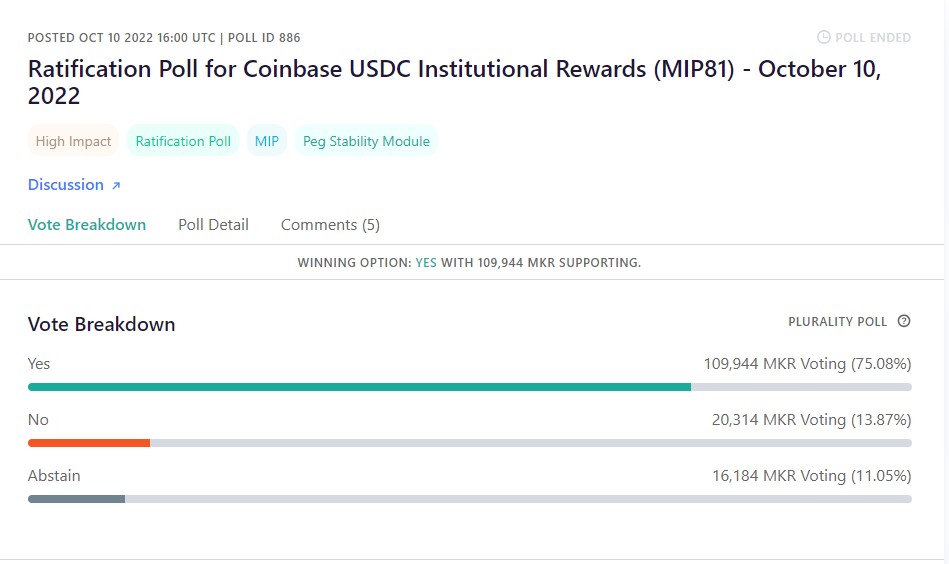

On October 24, the proposal received 75% of the votes cast, or 109,944 MKR tokens.

Coinbase believes that stablecoins will play an important role in the future of finance. Over the last few years, its USD Coin has increased its market share at the expense of industry leader Tether (USDT).

MakerDAO has now become the largest USDC holder. The additional monthly money generated by this arrangement, according to Jennifer Senhaji, growth and business development at MakerDAO, “enables Maker to further advance its overarching aim to establish a global, trustless financial future built on decentralized rails.”

However, the change erodes parts of Maker’s decentralized features, as it is now mostly collateralized by a centralized stablecoin.

USDC accounts for one-third of the treasury backing the Peg Stability Module, which enables users to deposit collateral in order to mint DAI.