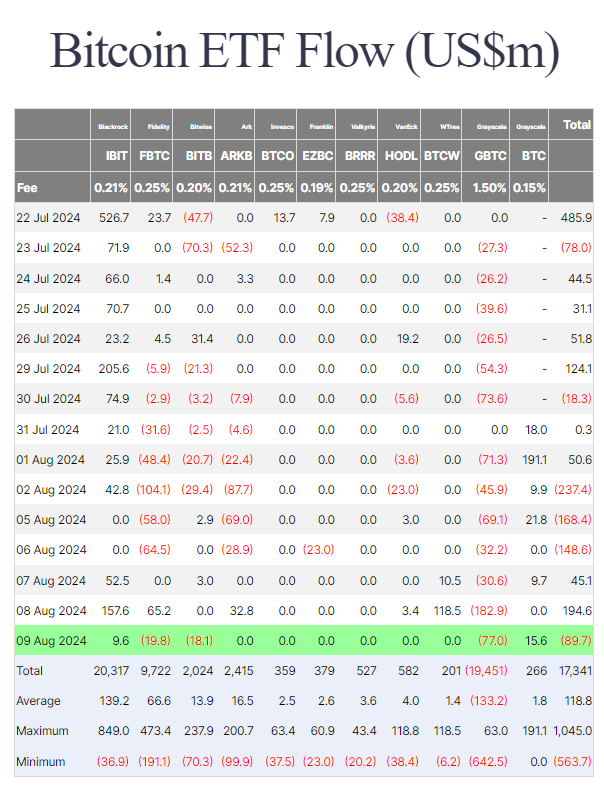

Farside Investors reports that BlackRock’s iShares Bitcoin Trust (IBIT) has established a dominant position in the market, boasting a net capital of more than $157 million.

WisdomTree’s Bitcoin fund (BTCW) saw a significant influx of nearly $118 million in a single day, marking its highest inflow since its establishment. Since its introduction in January, BTCW has faced difficulties in competing with other Bitcoin ETFs since its net capital has never surpassed $20 million until the recent increase on Thursday.

The fund has received a total of $201 million in inflows, which is still quite modest compared to its competitors. Fidelity, ARK Invest/21Shares, and VanEck, along with other Bitcoin ETFs, also experienced an increase in funds.

On Thursday, US spot Bitcoin exchange-traded funds (ETFs) received over $194 million in new investments, continuing their run of drawing funds after experiencing a loss of nearly $300 million earlier this week.

Last month, the US launch of spot Ethereum ETFs was a significant success for crypto enthusiasts and investors. BlackRock’s Ethereum ETF (ETHA) attracted $266.5 million in new investments, resulting in a daily trading volume above $1 billion. Grayscale Ethereum Trust (ETHE) experienced substantial outflows of $484.1 million, unlike other ETFs that experienced a mix of inflows and outflows.