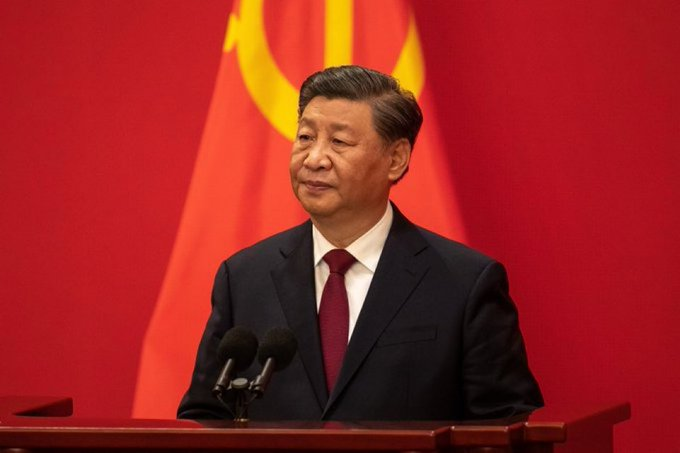

China has announced new tariffs on Canadian imports, escalating a trade dispute between the two countries. This decision is a response to earlier tariffs that Canada placed on Chinese goods.

The new tariffs will start on March 20, 2025, and will include a 100% tariff on rapeseed oil, oil cakes, and peas, along with a 25% tariff on aquatic products and pork.

The trade conflict began when Canada imposed tariffs on Chinese products to address China’s trade practices. In retaliation, China has now targeted Canadian exports. This situation reflects a broader trend of increasing global trade tensions.

The United States has also expanded its trade war, affecting the European Union, Mexico, Canada, and South Korea. The US actions are driven by concerns over national security and perceived unfair trade practices.

The impact of these tariffs is already visible in global markets. As China and the US continue to impose tariffs and other trade barriers, global trade has slowed down, and stock markets have become unstable. Companies, especially in manufacturing, are facing higher costs. Many producers and suppliers are now seeking new markets to reduce the effects of these tariffs.

Interestingly, amidst this trade turmoil, some sectors have seen unexpected changes. For example, the crypto market has gained some interest, possibly linked to discussions about a national crypto reserve proposed by the US government.

Additionally, under President Trump, the United States plans to introduce reciprocal tariffs that will affect nearly all US trade partners. These tariffs are expected to be announced on April 2, 2025, and will target what the White House views as unfair trade policies from countries like the European Union, Canada, and South Korea. Overall, the ongoing trade disputes are creating significant challenges for global trade and economies.