In a court brief submitted on Friday, the Securities and Exchange Commission (SEC) formally petitioned a judge to reject Coinbase’s request for an early appeal.

The legal dispute between Coinbase and the SEC started around one year ago, when the SEC accused Coinbase of engaging in illicit operations without proper registration and contravening securities laws via its Staking business.

The SEC’s brief argues that Coinbase’s dissatisfaction with the first rejection of its legal framework does not provide enough justification for an interlocutory appeal. The regulatory authority emphasized that a simple difference of opinion is insufficient to initiate an appeal.

Paul Grewal, Coinbase’s Chief Legal Officer, criticized the SEC on social media for its inconsistent approach to imposing penalties.

The individual observed that the SEC had previously supported a similar request in the Ripple case, which contradicts its current stance.

A number of legal proceedings commenced in March after Coinbase received notification from the SEC. In December, the Securities and Exchange Commission (SEC) rejected Coinbase’s plea for more precise regulations on cryptocurrencies, noting the presence of current legal provisions.

There has been increased controversy about the Securities and Exchange Commission’s (SEC) regulation of cryptocurrencies under the leadership of Chair Gary Gensler.

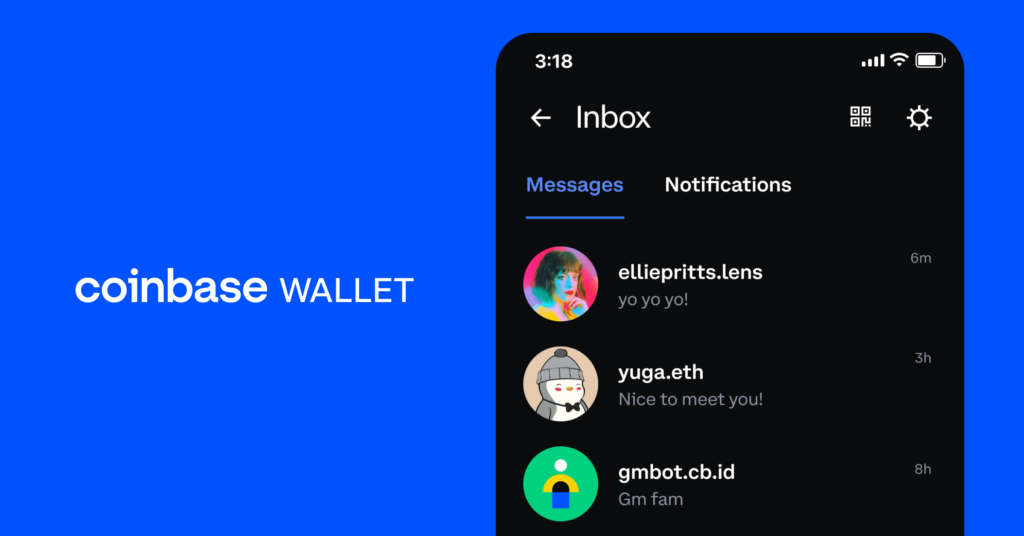

The court granted permission to the SEC to proceed with its proceedings against Coinbase’s Staking business and unregulated exchange, while dismissing the allegations against its wallet service.

Judge Katherine Polk Failla observed that Coinbase’s managerial activities may satisfy the Howey test for determining whether an investment qualifies as a security, so exacerbating its difficulties.