CoinGecko’s recently released 2023 Annual Crypto Industry Report sheds light on the state of crypto exchanges, highlighting the industry’s resilience and notable accomplishments this year.

The report examines the dynamics of both centralized crypto exchanges (CEX) and decentralized exchanges (DEX) throughout the year.

Despite the challenges faced by the crypto market, such as FTX’s collapse, global banking crises, and regulatory issues with Binance, the data shows that the market is recovering overall.

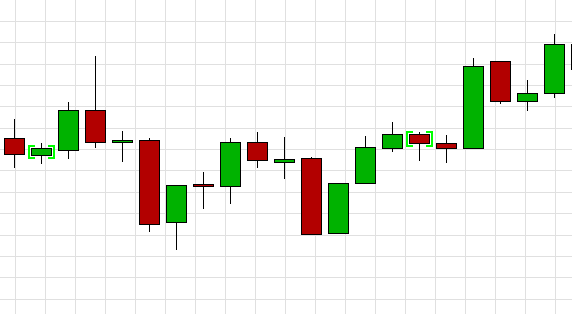

In 2023, the crypto market saw a significant trading volume of $36.6 trillion. A significant highlight is the 53.1% increase in volume between Q3 ($6.7 trillion) and Q4 ($10.3 trillion).

This surge in Q4 is attributed to rising bullish sentiment, fueled by the SEC’s approval of spot Bitcoin ETFs.

Despite these challenges, centralized exchanges (CEX) dominated the crypto landscape in 2023. Binance, Upbit, OKX, Bybit, and Coinbase are among the top ten CEXes in terms of trading volume. Despite a decline in market share throughout the year, Binance has maintained its dominance.

Binance’s resilience is demonstrated by its ability to remain on the list despite having a yearly low market share of 41% in November. The exchange’s performance demonstrates its flexibility and resilience in the face of market volatility.

In Q4 2023, the top ten CEXs saw a staggering +98.1% increase quarter-on-quarter (QoQ), with $2.20 trillion in spot trading volume.

This surge represented a significant improvement, given that the previous two quarters had failed to breach the $2 trillion mark.

Despite the impressive quarterly growth, the report shows a -23.4% year-on-year (YoY) drop in spot trading volume for the top ten CEXs. In 2023, these exchanges recorded $7.2 trillion in spot trading volume, compared to $9.4 trillion in 2022.