Fidelity’s FBTC was the top recipient of $105 million in inflows for the US spot Bitcoin ETF on June 3, 2024. These Exchange-Traded Funds (ETFs) have had 15 consecutive days of capital inflows, suggesting strong investor interest.

As of June 3, SoSoValue has reported $13.96 billion in net inflows from 11 Bitcoin ETFs licensed in the United States. Within the last 24 hours, a total of $105 million was allocated for investment, with FBTC receiving the majority share of $77 million. Bitwise’s BITB followed closely with a total of $14 million.

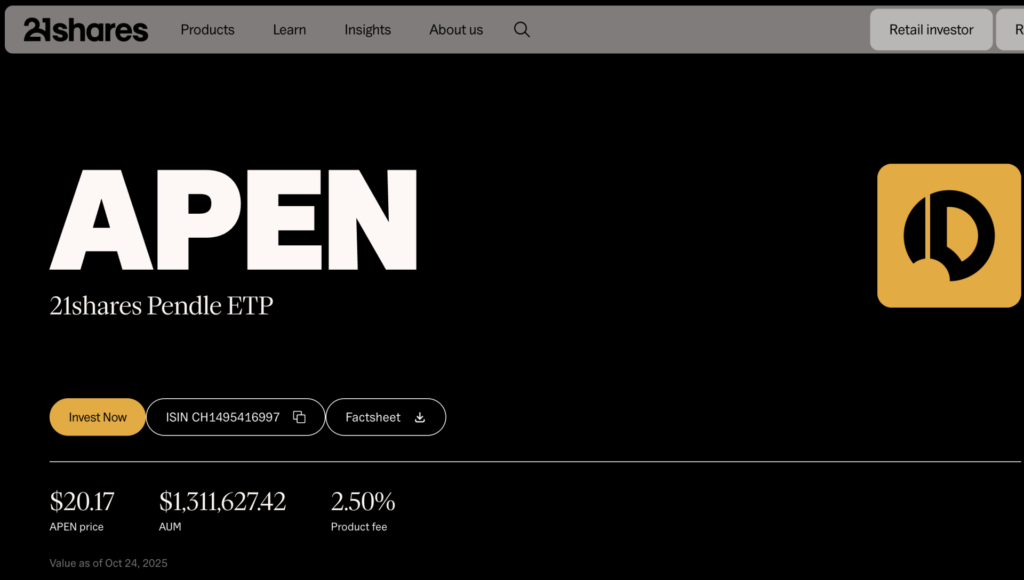

Simultaneously, Ark Invest and 21Shares’ ARKB received a total of $11 million, although VanEck and WisdomTree’s spot ETFs each obtained less than $2 million.

Despite their large magnitude, both Grayscale and BlackRock did not receive any new investments on Monday. BlackRock’s iShares Bitcoin Trust (IBIT) just overtook Grayscale Bitcoin Trust (GBTC) to become the largest cryptocurrency exchange-traded fund (ETF) globally, with around $20 billion in assets.

CoinShares announced a global influx of $2 billion in cryptocurrency investment products in May. Incorporate the markets of the United States, Europe, and Hong Kong. The surge was propelled by the approval of Bitcoin and Ethereum ETFs in Hong Kong on April 30, 2024. The first Bitcoin exchange-traded fund (ETF) in Australia, Monochrome, has been officially listed on Cboe Australia.

The Bitcoin ETF managed by One Asset Management has been approved in Thailand days ago. Thai institutional investors may securely allocate their investments to leading global Bitcoin funds.