Bitcoin’s recent price drop has raised worries for investors about the future of the cryptocurrency market, especially since altcoins usually follow Bitcoin’s lead. Even with this decline, Matrixport has pointed out past trends and other elements that could suggest Bitcoin might bounce back next year.

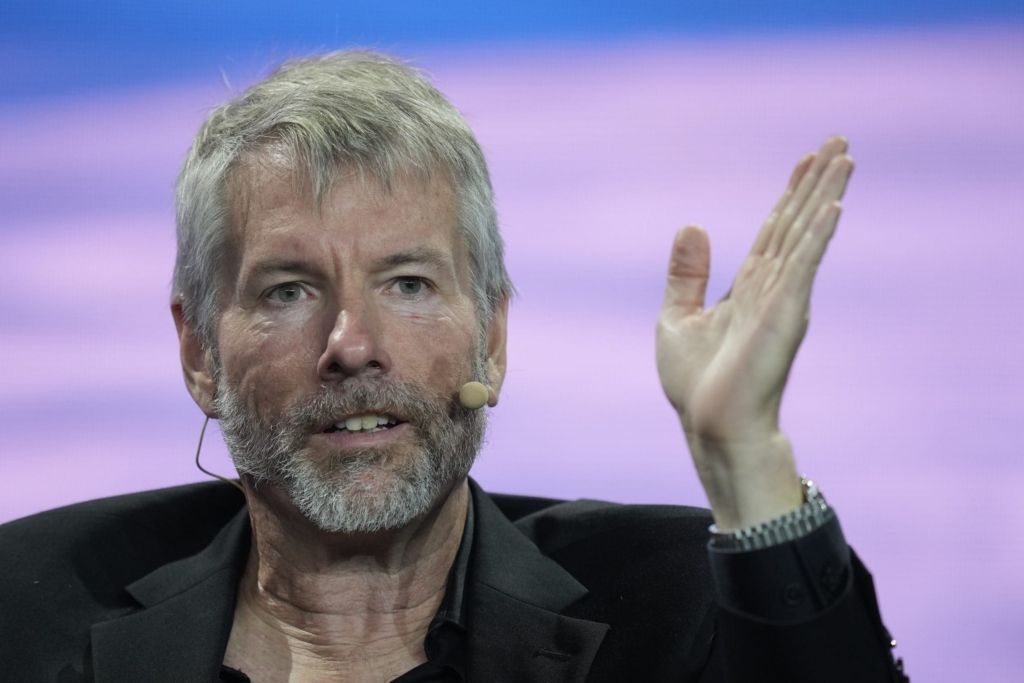

MicroStrategy, a well-known software company, has boosted its Bitcoin holdings to 446,400 BTC after buying 2,138 BTC for $209 million at an average price of $97,837 each. This is the eighth purchase in eight weeks, with the company spending about $27.9 billion on Bitcoin at an average price of $62,428 each.

MicroStrategy’s Bitcoin investments have seen great returns, with a 47.8% yield for the quarter and 74.1% for the year. The company is planning a meeting with shareholders to talk about buying more Bitcoin, which will strengthen its status as the biggest public holder of Bitcoin.

MicroStrategy’s stock price has dropped a bit, now trading at about $315, which is down more than 4%. The company’s link to Bitcoin has caused its stock value to rise by 400% this year, showing the effect of its cryptocurrency approach.