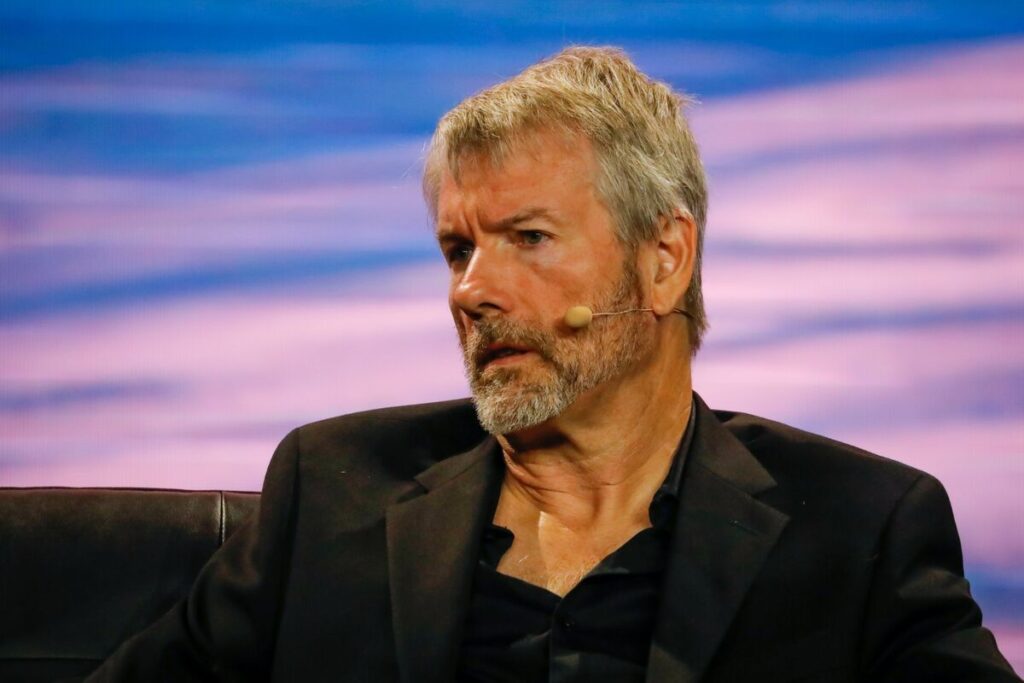

Michael Saylor, the chairman of MicroStrategy, has announced the acquisition of an additional 16,130 BTC for a total of $593.3 million in the cryptocurrency market. This transaction was completed at an average price of $36,785 per Bitcoin.

MicroStrategy’s Bitcoin holdings had increased to 174,530 BTC as of November 29, with a total investment of more than $5.28 billion. Their portfolio’s average cost per Bitcoin is $30,252.

This recent acquisition demonstrates MicroStrategy’s unwavering belief in Bitcoin and solidifies its position among prominent corporate Bitcoin holders.

This latest development follows MicroStrategy’s recent purchase of 155 Bitcoin for $5.3 million, emphasizing the company’s commitment to its Bitcoin-centric strategy.

MicroStrategy’s CEO, Phong Le, has previously stated that the company intends to acquire and hold Bitcoin as a unique and valuable asset.

Despite a net loss of $143.4 million, MicroStrategy remains committed to its Bitcoin strategy. This loss occurred despite a 3% increase in quarterly sales to $129.5 million.

Michael Saylor, who has been a vocal advocate for Bitcoin as a hedge against inflation and a store of value, is at the helm of MicroStrategy’s cryptocurrency strategy. MicroStrategy first entered the Bitcoin market in August 2020, marking its first foray into the digital asset.

According to the most recent market data, Bitcoin is currently trading at $37,656, down 0.13% in the last 24 hours. The crypto has been riding a wave of strong bullish momentum, with increased excitement surrounding the upcoming halving event in April next year.

Investors and industry observers are keeping a close eye on MicroStrategy’s moves, which they believe are indicative of broader trends in corporate adoption and investment strategies in the cryptocurrency space.