In a groundbreaking move, the FBI has charged three cryptocurrency firms—Gotbit, ZM Quant, and CLS Global—along with 15 individuals for market manipulation, marking a significant step in the fight against fraudulent trading in the digital asset arena. This case is particularly notable as it involves the FBI creating a fake cryptocurrency token to ensnare the accused firms in their deceptive practices.

The investigation revealed that these companies engaged in sham trading to artificially inflate their trading volumes, luring unsuspecting investors into a false sense of market activity. With substantial evidence, including recorded calls and video interviews, prosecutors have built a strong case against the defendants.

Notably, ZM Quant’s executive Riuqi “Ricky” Liu was recorded admitting to using multiple wallets to manipulate trading volumes, while Gotbit’s CEO Aleksei Andriunin was implicated through a revealing YouTube interview from 2019.

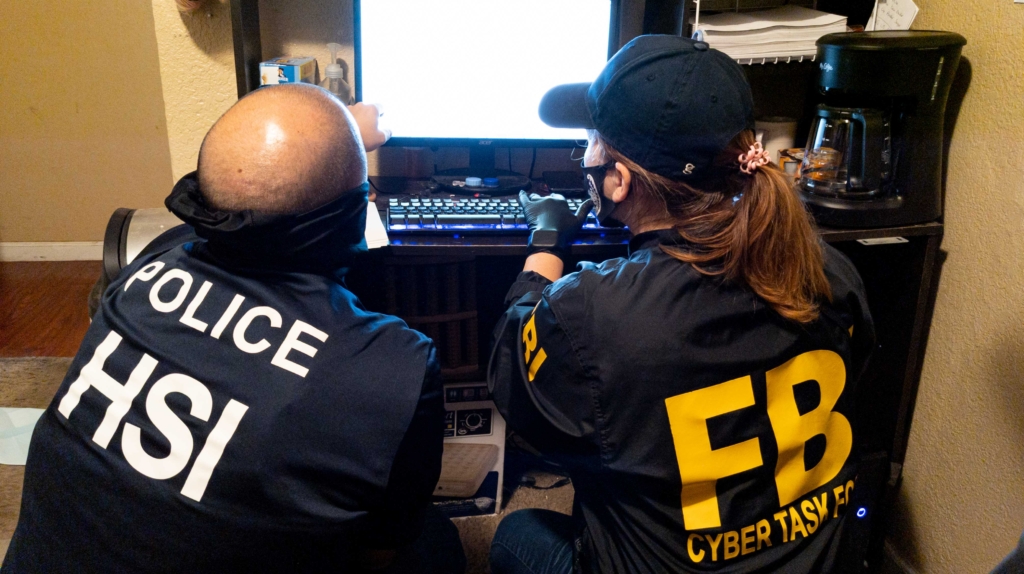

The FBI’s innovative undercover operation signals a new approach to tackling financial crimes in the crypto sector, potentially setting a precedent for stricter enforcement against unethical market practices. With five individuals already pleading guilty and significant digital assets seized, this case could serve as a stern warning to other firms engaging in similar activities.

As the investigation continues, authorities are considering further actions against additional companies involved in deceptive trading practices. This high-profile case not only highlights the urgent need for regulation in the crypto market but also suggests that the landscape of oversight and enforcement in digital finance may soon undergo significant changes.