XXKK Exchange, a global crypto trading platform, has successfully completed a comprehensive upgrade to its system-wide security architecture. The update strengthens key components of the platform’s trading engine, user protection mechanisms, blockchain-based asset storage, and compliance infrastructure.

This milestone reinforces XXKK’s commitment to building a multi-layered, institution-grade defense system tailored to the evolving needs of digital asset traders, while aligning with international regulatory frameworks and Web3 infrastructure standards.

Amid rising global threats targeting crypto platforms—ranging from smart contract exploits to cross-chain bridge vulnerabilities—XXKK Exchange continues to maintain a zero major incident record. The platform prioritizes proactive, prevention-first security over reactive patching, investing in long-term resilience and sustainable blockchain governance.

Key Security Enhancements

The upgrade introduces five core improvements:

- Trading System: A modular, permission-tiered architecture now governs matching engines, risk modules, and transaction channels—limiting lateral threat movement and ensuring fault-tolerant scaling.

- Key and Asset Management: Next-generation Hardware Security Modules (HSMs) now manage both cold and hot wallet keys, with multi-signature protocols and scheduled key rotation. An asset protection fund has also been launched, offering up to $1 million in compensation for users affected by platform-level failures.

- User Account Security: Enhanced two-factor authentication (2FA), behavioral login modeling, and real-time detection of high-risk wallet addresses using on-chain reputation analytics now protect user accounts.

- Real-Time Risk Engine: A dynamic risk engine continuously analyzes blockchain activity, withdrawal patterns, and API traffic. It automatically triggers throttling, freezing, or internal audits in response to suspicious activity—mitigating exposure to DeFi-related attack vectors.

- Compliance and Transparency: XXKK has launched a quarterly penetration testing program and initiated third-party SOC 2 Type I certification. These efforts lay the groundwork for a transparent, standards-based crypto audit trail.

Executive Statement

“User fund protection cannot rely on promises alone—it must be backed by real technical strength,” said Emmalyn, Head of XXKK Exchange. “We’ve developed a resilient architecture that incorporates encrypted asset segregation, access control tiers, advanced risk modeling, and continuous auditing. Our asset protection fund also ensures financial recourse in the rare event of system failure.”

“As we scale globally, security is no longer a reactive function—it’s the foundation of our infrastructure. We’re committed to investing in automated defenses, compliance frameworks, and user risk education to maintain zero-incident operations across all conditions.”

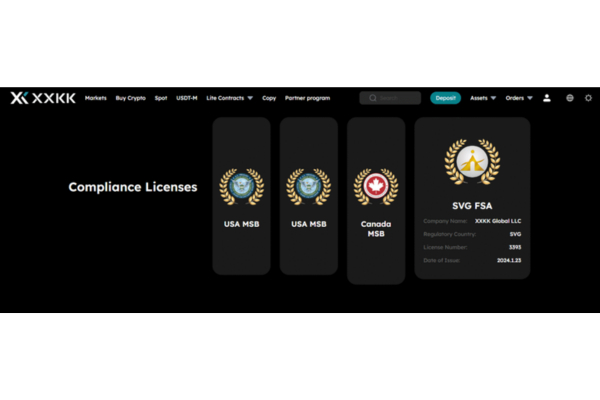

Regulatory Licenses

XXKK Exchange currently holds the following regulatory registrations:

- S. MSB Registration: License #31000222694535 (August 5, 2022)

- Canadian MSB License: License #M22420435 (September 8, 2022)

- Saint Vincent FSA License: License #3393 (January 23, 2024)

Upcoming Initiatives

Later this year, the platform will publish its inaugural Annual Security and Transparency Report, which will include:

- Proof of Reserves (PoR)

- Emergency response protocols

- Third-party security partnerships

- Internal control disclosures

With the support of a dedicated compensation fund and robust technical safeguards, XXKK Exchange remains focused on achieving its operational goal of “zero user losses.”

About XXKK Exchange

XXKK Exchange is a globally leading multi-asset crypto platform, founded by professionals with deep expertise in both traditional finance and blockchain technology. By bridging institutional-grade systems with Web3 innovation, the platform delivers secure, efficient, and compliant crypto trading experiences worldwide.

To learn more, users can visit: www.xxkk.com

Disclaimer: Any information written in this press release does not constitute investment advice. Optimisus does not, and will not endorse any information about any company or individual on this page. Readers are encouraged to do their own research and base any actions on their own findings, not on any content written in this press release. Optimisus is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release.