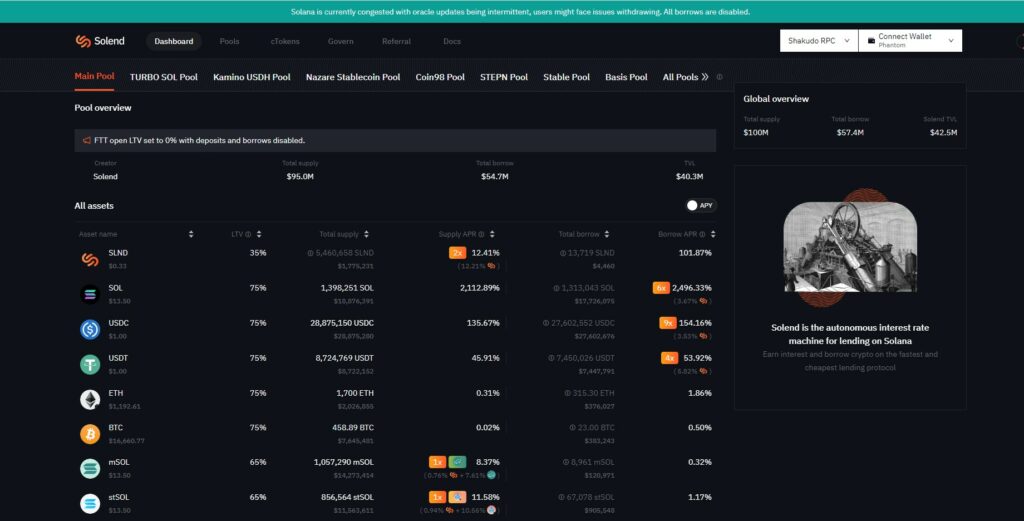

A significant lending position on the Solana-based lending platform Solend is now underwater, but infrastructure issues are preventing it from being liquidated properly. As a result, the protocol risks incurring bad debt.

The loan is part of Solend’s primary lending pool. A 50% drop in the price of Solana (SOL) in the last three days has reduced the value of the collateral used for the loan.

Under normal circumstances, other market participants would have liquidated the loan. However, the platform has encountered Oracle issues related to network congestion, frustrating these efforts.

This loan is held by a large user who has the largest position in the main pool. At the time of writing, the user owed the protocol $29.7 million in USDC against $32.6 million in SOL collateral.

The position is above Solend’s 85% liquidation threshold of $27.6 million. To bring the loan back under the liquidation threshold, the protocol must sell nearly $2 million in SOL collateral.

While the protocol has been liquidating collateral from the position in order to protect its assets, it has been hampered by Solana’s congestion issues.

“Solana is currently congested with oracle updates being intermittent, users may experience withdrawal issues,” the lending platform warns.

Despite technical difficulties, the project clarified that the owner of the large loan is slowly liquidating it.

“Congestion on Solend has improved, and partial liquidations of the whale account have been taking place with no major issues,” Solend tweeted.