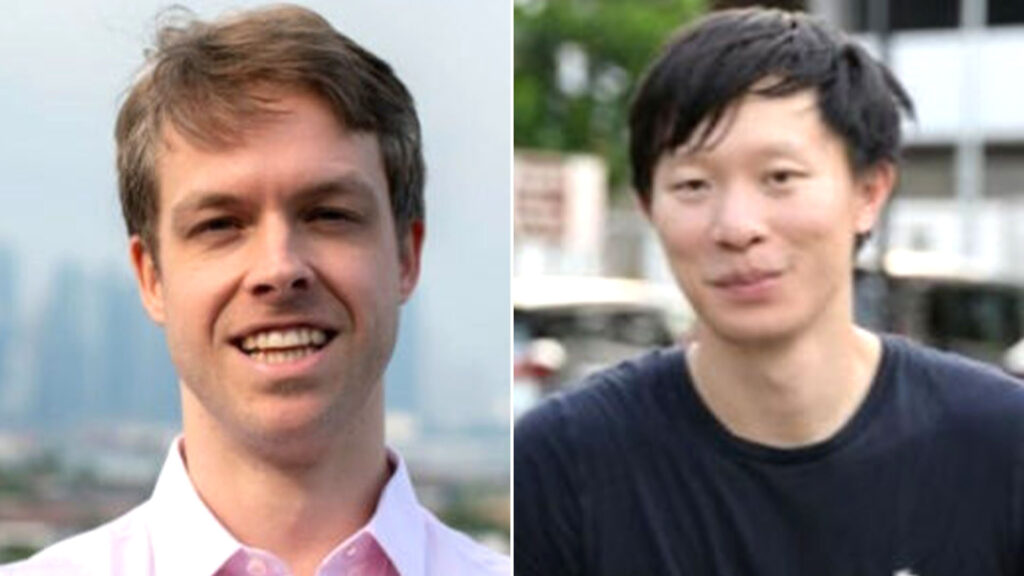

Su Zhu and Kyle Davies are unknown to the general public, therefore the company in charge of 3AC’s liquidation requested authorization from a US court to subpoena them via email and Twitter.

Teneo, the foreign representative of the bankrupt cryptocurrency hedge fund Three Arrows Capital (3AC), has requested permission to use an unusual means of serving subpoenas to co-founders Su Zhu and Kyle Davies for the production of documents and testimony because they have “yet to offer any forthright cooperation.”

They requested that subpoenas be delivered to the founders via their Twitter accounts, their email addresses, and the email address of Advocatus Law, the Singapore-based attorney “purporting to represent the founders,” in a document submitted on October 14.

In the Southern District of New York, 3AC is requesting Chapter 15 protection from creditors, which enables international debtors to protect US assets.

According to earlier court records, Zhu and Davies were both obstructive with the liquidators. And according to the most recent development, they continue to show no sign of engagement.

According to the complaint, foreign officials asked Advocatus to accept the papers because their whereabouts “remain unknown.” However, the law company turned down the opportunity to serve its clients.

Teneo had already asked Advocatus for an urgent meeting with the founders, but it had been rejected. Despite being directly questioned, neither Zhu nor Davies responded, according to Friday’s motion, but they did offer an introductory Zoom call.

They have declined to assist the liquidators’ attempts to access the books and records of 3AC that are in their custody, giving only “meager information” that consists of an incomplete list of the company’s assets and selective disclosures, the complaint continued.

The founders of 3AC would be required to provide records that “identify the existence of, location of, and method of accessing and controlling” firm assets if the subpoenas were approved.

The foreign representatives have also demanded access to more crucial material from Solitaire, the Singapore attorney “purporting to represent” the former investment manager of 3AC, and they think the company is hiding pertinent and essential information.

The submission stated that the Investment Managers’ patchwork, selective disclosures were insufficient and that their lack of open cooperation prevented the Foreign Representatives from carrying out their obligations.