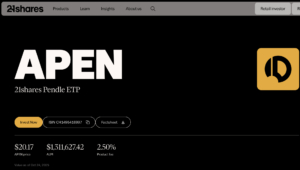

21shares Launches a Pendle ETP on SIX Swiss Exchange Indicating Growing Institutional Recognition for Pendle

Asset manager 21Shares has launched an exchange-traded product (ETP) called APEN based on Pendle — a development that signals deepening institutional recognition of Pendle’s role in bridging traditional fixed-income markets with Decentralized Finance (DeFi). One of the most notable metrics underlining Pendle’s traction is its recent achievement: the protocol has settled $70 billion in yield, effectively creating a bridge between the roughly $140 trillion global fixed-income market and crypto-native infrastructure. This milestone is supported by