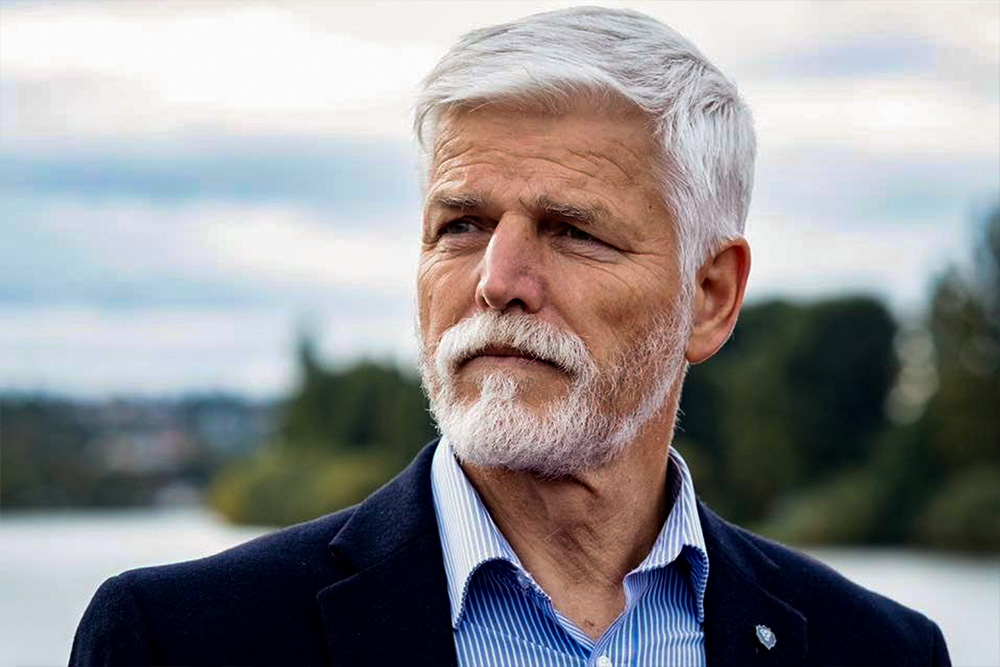

Czech President Petr Pavel recently signed a new bill that benefits crypto users. This law states that if individuals hold their crypto assets for more than three years, they will not have to pay taxes on any profits made from selling them.

Additionally, transactions involving amounts up to CZK 100,000 (around $4,136) each year will not need to be reported in tax declarations. This approach aligns with how securities are treated in the country.

The new regulation is part of the Czech Republic’s Digitalization of the Financial Markets Act. It is currently in the final stages of the legislative process and is expected to be officially published within a week or two. The Czech Republic is a member of the European Union (EU), which adds significance to this development.

In a related event, the Czech National Bank’s Governor, Aleš Michl, proposed that the central bank consider including assets like bitcoin in its reserves. This proposal received approval from the bank’s board just a week ago. However, it faced criticism from Christine Lagarde, the president of the European Central Bank.