Celsius Initiates Fund Withdrawals Following Bankruptcy Filing

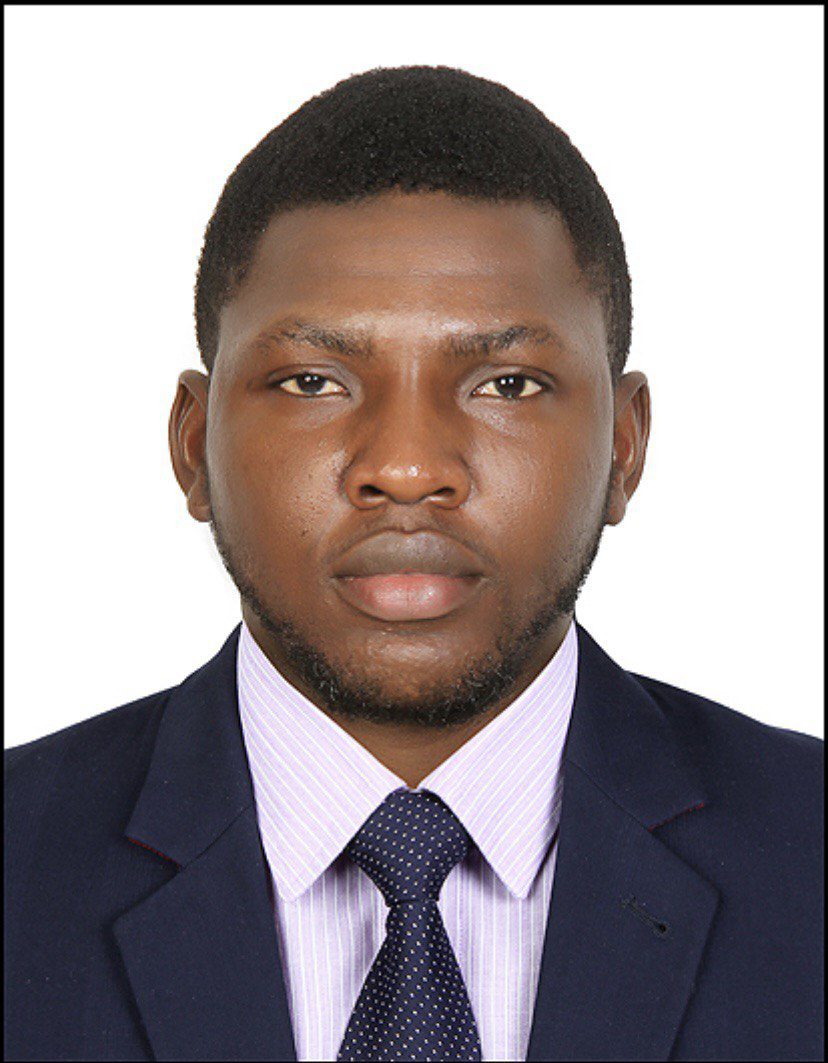

Celsius, a popular crypto lending firm, has recently announced that its customers can now withdraw assets from its platform after eight months of waiting. The announcement came in the form of an official tweet on March 2, revealing that withdrawals are now available for certain custody accounts only. This development follows a court order in January, which authorized Celsius to process withdrawals, but only for assets in a Celsius custody