Known for taking a bullish position on Bitcoin (BTC), MicroStrategy has increased the size of its crypto holdings, which as of January stood at 190,000 BTC.

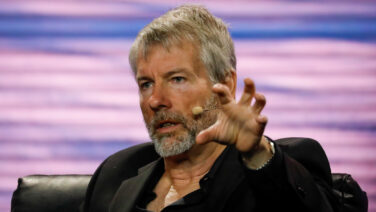

Under the direction of Executive Chairman Michael Saylor, the firm spent $37.2 million to buy an extra 850 BTC at an average cost of $43,764—a little bit more than the $43,200 current market value.

In addition, the company disclosed an average price of $31,224 in its year-end financial disclosure for Bitcoin purchases, demonstrating the firm’s systematic approach to acquisitions.

“With 31,755 Bitcoins added since the last quarter, we’ve seen our largest quarterly boost in three years, continuing our streak of Bitcoin investments for the 13th consecutive quarter,” the company stated.

However, this high-risk approach to Bitcoin investing is accompanied by financial difficulties, as seen by a 6.1% year-over-year decline in quarterly revenue. And also a drop in gross profits from $105.8 million to $96.3 million.

Despite these setbacks, MicroStrategy now has more Bitcoin than the combined value of all nine recently launched Bitcoin ETFs, with around 181,000 BTC.

This sizeable investment, which accounts for almost 1% of all Bitcoins, highlights the company’s clout in the crypto space.

It is worth mentioning that Saylor has begun selling over $200 million of his personal MicroStrategy shares in an audacious move that demonstrates his faith in Bitcoin.

This is even though MSTR stock has seen a 16% decline in value since the introduction of Bitcoin ETFs. The move by MicroStrategy to increase the size of its Bitcoin holdings despite market volatility and financial downturns demonstrates the company’s strong belief in the future of the digital asset.

Last month, MicroStrategy and its subsidiaries acquired an additional 14,620 BTC for a total of $615.7 million in cash during this period.