Mayowa Adenle

I am a crypto analyst. I am responsible for analyzing and predicting trends, pricing, demand, and trading volumes of any number of cryptocurrencies currently available.

Articles by Mayowa Adenle

2 years ago

1 min read

Binance US is getting ready to re-bid for the assets of the insolvent lending platform Voyager Digital, CoinDesk reported. Voyager Digital chose FTX.US to purchase its assets for $1.42 billion less than eight weeks prior to filing for Chapter 11 bankruptcy in July 2022. But after its collapse, the bankrupt crypto lender was left without a buyer. The American division of Binance, the largest cryptocurrency exchange in the world by volume, is getting ready to make another offer for the assets of struggling lender Voyager Digital. In July 2022, Voyager Digital voluntarily started a Chapter 11 restructuring process. After a

2 years ago

1 min read

Following the exchange’s most recent mishap, the Australian Securities & Investments Commission (ASIC) suspended the FTX Australia license until May 15, 2023. About 30,000 Australian consumers have been impacted by the crash and are looking into ways to get their money back. FTX’s Australian subsidiary will be able to offer restricted services to local clients until December 19, 2022, despite the license’s expiration. In addition, FTX was notified by the ASIC that it was authorized to provide general advice relating to derivatives and foreign exchange contracts to retail and wholesale clients. However, the collapse of FTX reversed the trends, forcing

2 years ago

1 min read

According to a report, Binance, the world’s largest cryptocurrency exchange, has been granted Financial Services Permission (FSP) by the Financial Services Regulatory Authority (FSRA) in the Abu Dhabi Global Market (ADGM). Binance will be able to provide custody to professional clients through the FSP if they meet the FSP’s conditions as outlined by the FSRA. Following the news, Richard Teng, MENA and Europe Regional Head, stated: “Working with the ADGM and FSRA has been a highly collaborative process that underscores the value of cooperation between our industry and the public sector.” In April 10, 2022, the Financial Services Regulatory Authority

2 years ago

1 min read

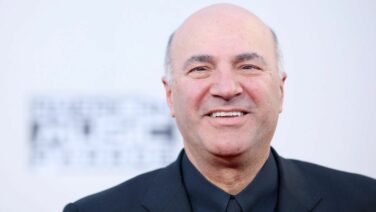

Despite losing money on FTX, Canadian businessman and Shark Tank star Kevin O’Leary believes Sam Bankman Fried’s future businesses are worth investing in. O’Leary recently disclosed the extent of his exposure to the exchange, arguing that the company’s demise has a “silver lining.” Mr. Wonderful admitted in an interview on Tuesday that FTX was one of his “bad investments,” but that it is still safe due to his asset diversification. Nonetheless, the investor took a “significant hit.” He claimed to be a shareholder of FTX and FTX US, with multiple accounts with the exchange that have now been frozen. Additionally,

2 years ago

1 min read

According to a recent court document, the insolvent crypto exchange FTX may have more than one million creditors. Sam Bankman-Fried’s crypto exchange, FTX, which filed for bankruptcy last week, estimated that it may have more than a million creditors, illustrating how challenging it will be to resolve this insolvency. There are more than 100,000 creditors in these Chapter 11 cases, according to a court document that was added to the federal court database system on November 15. In actuality, there might be a million or more creditors. The failed crypto exchange group, which also includes sister trading firm Alameda Research,

2 years ago

1 min read

Elon Musk responded to a tweet about Bitcoin (BTC) by saying it will “make it.” The owner and CEO of Twitter predicts that the crypto winter will be long. Musk made the comments during a conversation with angel investor Jason Calacanis and artist D. A. Wallach. Calacanis started the conversation by asking where BTC might be in a year, given that it has already dropped from $69,000 to $16,000 in the last year. Furthermore, in response to a user’s joke question about Dogecoin (DOGE), Musk stated that he feels the same way about the memecoin. Musk became noticeably more involved

2 years ago

1 min read

As it did following the bankruptcy of 3AC, Genesis Trading, the most recent company to declare exposure to FTX, may seek assistance from its parent company. Genesis Trading, the market maker and lending arm of Digital Currency Group, disclosed that its derivatives business has about $175 million in funds stashed away in an FTX trading account in what it describes as an effort to be transparent. The information was released by Genesis in a thread of tweets on November 10; the company made it clear that the locked funds “would not impact our market-making activities.” Additionally, Genesis declared that they

2 years ago

1 min read

The Department of Justice (DoJ) and the Securities and Exchange Commission (SEC) are collaborating to investigate FTX’s subsidiary in the United States. The Department of Justice (DoJ) and the Securities and Exchange Commission (SEC) are collaborating to investigate FTX’s U.S. subsidiary, according to Bitcoin Magazine, citing Bloomberg. Multiple regulators have expressed concern about FTX, which is now facing possible bankruptcy. According to the newspaper, the SEC is in close contact with the DoJ as its months-long investigation into whether assets on FTX.us may be considered securities continues. If the SEC rules that the assets in question are securities, FTX may

2 years ago

1 min read

Sepana, a decentralized search startup, closed a $10 million funding round. The $10 million funding round was led by the venture capital firms Hack VC and Pitango First, according to decentralized search startup Sepana, which made the announcement today. In the startup’s funding round, Protocol Labs, Lattice Capital, and Balaji Srinivasan also participated. Daniel and David Keyes, two brothers, founded Sepana, which aims to increase the discoverability of web3 content like DAOs and NFTs through its search tooling. A future web3 search API that aims to make it possible for any decentralized application (dapp) to integrate with its search infrastructure

2 years ago

2 mins read

CZ said Binance will liquidate its remaining FTT tokens issued by the second-largest crypto exchange FTX on November 6. This decision comes after CoinDesk reported November 2 that FTX’s sister company, Alameda Research, may have solvency issues. CZ said, “Due to recent revelations that have [come] to light, we have decided to liquidate any remaining FTT on our books.” In addition, Binance’s CEO mentioned that since Binance withdrew from FTX’s equity last year, it has received $2.1 billion worth of stablecoins BUSD and FTT. According to a CoinDesk report from November 2, a financial report from Alameda Research revealed that as of June 30, the company’s

2 years ago

1 min read

Coinbase, the most renowned American crypto exchange, recently released its third-quarter 2022 report. However, its sales figures are unimpressive. Furthermore, the exchange recently released its third-quarter report, which fell short of most analysts’ estimates. According to the report, Coinbase’s revenue fell by half from the previous year due to changes in trading activity. As a result, the company lost around $545 million, compared to a profit of $406 million in the third quarter of 2021. Coinbase informed its stockholders of the decline in revenue. It stated that the firm’s negative posture was created by poor macroeconomic conditions and a decreasing

2 years ago

1 min read

As part of its fintech accelerator, the Mastercard Start Path program, global payments giant Mastercard continues to support cryptocurrency and blockchain startups. Mastercard announced on November 3 that it has chosen seven more industry startups for its Start Path program to promote the adoption of crypto and blockchain technology. Fasset, Singapore’s crypto payments platform Digital Treasures Center, and Colombian stablecoin-focused firm Stable are among the new startups in the new cohort. Mastercard previously collaborated with Fasset in July to develop digital solutions to promote financial inclusion in Indonesia. The latest Mastercard Start Path program also includes Loot Bolt, a Web3-focused