Late last night, Tether, the world’s largest stablecoin issuer, minted another billion USDT tokens on the Ethereum network.

According to Tether CTO Paolo Ardoino, this is part of an “inventory replenish” and will be used to meet the next period of issuance requests and chain swaps.

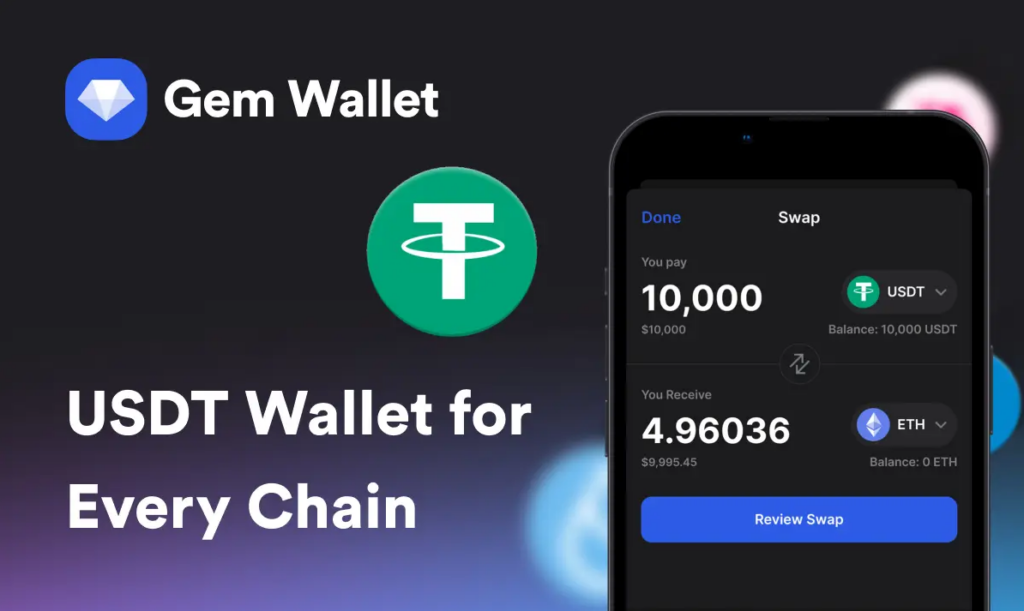

As the most popular stablecoin in the crypto industry, USDT is pegged 1:1 to the United States dollar and is widely used to facilitate trading on large exchanges that don’t accept fiat currencies.

On the Ethereum blockchain, Tether has emerged as the dominant stablecoin issuer, with over 35 billion tokens. Its closest competitor, USDC, issued by Circle, has less than 30 billion tokens.

Meanwhile, Binance USD makes up less than seven billion tokens. When taking into account the entire stablecoin supply across multiple blockchains, Tether’s dominance in the sector further intensifies, with USDT comprising over 81.5 billion dollar-pegged tokens.

The supply of USDT has historically indicated the direction in which the price of Bitcoin and the crypto market will trend.

Tether usually issues new USDT when there is a higher demand for it, indicating that new cash is coming into the system and is generally used to buy bitcoin, ether, and other cryptocurrencies.

A study conducted by BDC Consulting last June found that the supply of USDT “does feature a strong and statistically significant correlation” with the bitcoin price.

In February, Tether reported a net profit of $700 million for Q4 2022, reflecting excess reserves of at least $960 million. With its latest USDT issuance, Tether has cemented its position as the dominant stablecoin issuer in the market.