Cryptocurrency investment products centered around the native token of the XRP Ledger, XRP, have witnessed an impressive surge in assets under management (AUM) by 127% in the current year.

A recent milestone marked their sixteenth consecutive week of inflows, with a substantial $500,000 invested in these products.

The dynamics behind this growth, including regulatory advancements and evolving market trends, are positioning XRP investment offerings in a promising light.

According to the latest Digital Asset Fund Flows Weekly report by CoinShares, the substantial rise in AUM accounts for 12% of the total assets managed by these cryptocurrency investment products.

The growing confidence among investors in XRP stems from a significant legal development earlier this year when Judge Analisa Torres differentiated between sales of XRP to institutional investors and on exchanges, highlighting the token’s non-securities status.

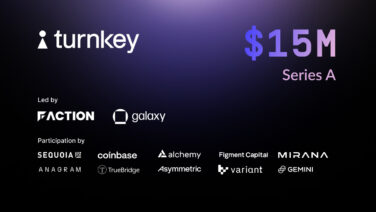

The legal ruling led to a notable resurgence in XRP’s liquidity, prompting prominent cryptocurrency exchanges including Coinbase, Kraken, and Gemini to relist the token.

This renewed accessibility further fueled investor interest and contributed to the asset’s upward trajectory. However, recent developments have introduced a new layer of uncertainty as the U.S. Securities and Exchange Commission (SEC) announced its intent to challenge aspects of the ruling.

The SEC’s “interlocutory appeal” centers on clarifying whether certain XRP sales and offers by Ripple, particularly over cryptocurrency trading platforms and in exchange for services, align with the parameters outlined by the Howey test—a legal standard for determining securities.

This move highlights the ongoing regulatory discourse surrounding XRP and its potential implications on the broader cryptocurrency market.

The XRP Ledger has been bustling with activity, registering over 1.2 million daily transactions since the start of August.

Impressively, this figure surpasses the daily transaction count of Ethereum ($ETH), which ranks as the second most popular network in the cryptocurrency domain with 1.09 million transactions per day.

Such robust blockchain utilization underscores $XRP’s practicality and market relevance.

In light of these developments, it’s important to note that XRP’s market capitalization has undergone fluctuations, experiencing a decline of nearly $10 billion from its peak earlier this year.

CoinShares’ report highlights that the past week has witnessed a notable influx of $29 million into digital asset investment products, effectively ending a three-week streak of outflows.

Among these inflows, Bitcoin-focused products captured $27 million, while Ethereum-focused offerings attracted $2.5 million.