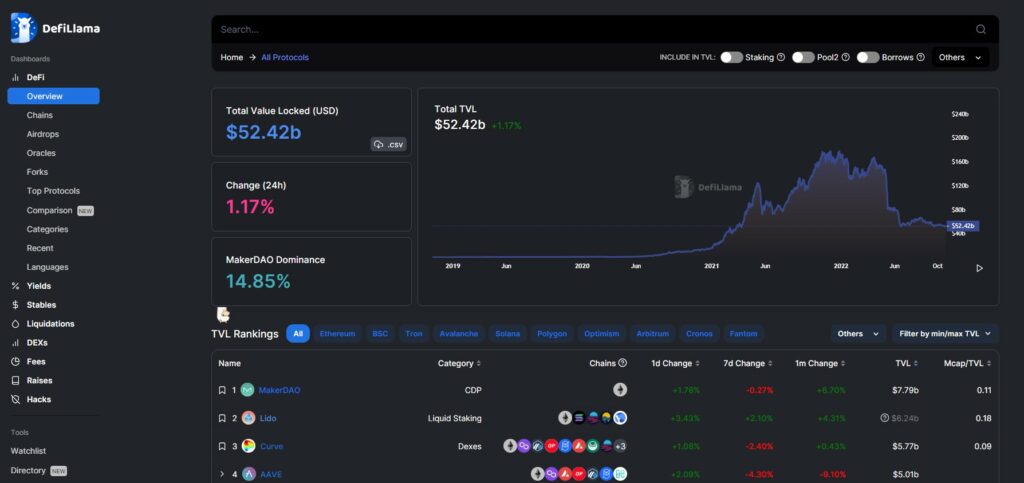

DeFiLlama, a DeFi data platform, has created a new tool to help token farmers identify more yielding farming possibilities.

Delta Neutral Yields, a product that DeFiLlama has been working on for months, was announced on October 23.

The technology searches the platform’s enormous database for possibilities where users can borrow tokens to farm with. It says that with the new approach, yields of more than 20% are possible with BTC, ETH, and USDC.

On its website, DeFiLlama provides the strategy finder for free. The caution is that many of the proposed coins have little liquidity and may be associated with dangers.

DeFiLlama demonstrated how its new strategy finder works with a few instances. One method was leveraged farming with Avalanche staking, in which BTC.b (BTC bridged to Avalanche) is put on Aave in order to borrow AVAX, which is staked in order to produce sAVAX. This is returned to Aave in order to borrow more and leverage the position, yielding up to 22% APY.

Arbitrage against a yield generator was another recommended technique. Users can give Ethereum in order to borrow DAI, which they can subsequently deposit into Reaper Farm for approximately 16% returns.

According to DeFiLlama, there are dozens of such schemes that allow users to keep exposure to the original assets while farming better returns supplied by other tokens. These are not, however, “set and forget” farms.

The platform also includes a project filter for individuals who do not want to be exposed to fraudulent DeFi protocols.

This year, the DeFi data site has expanded its offers with new data sets and tools for token producers.